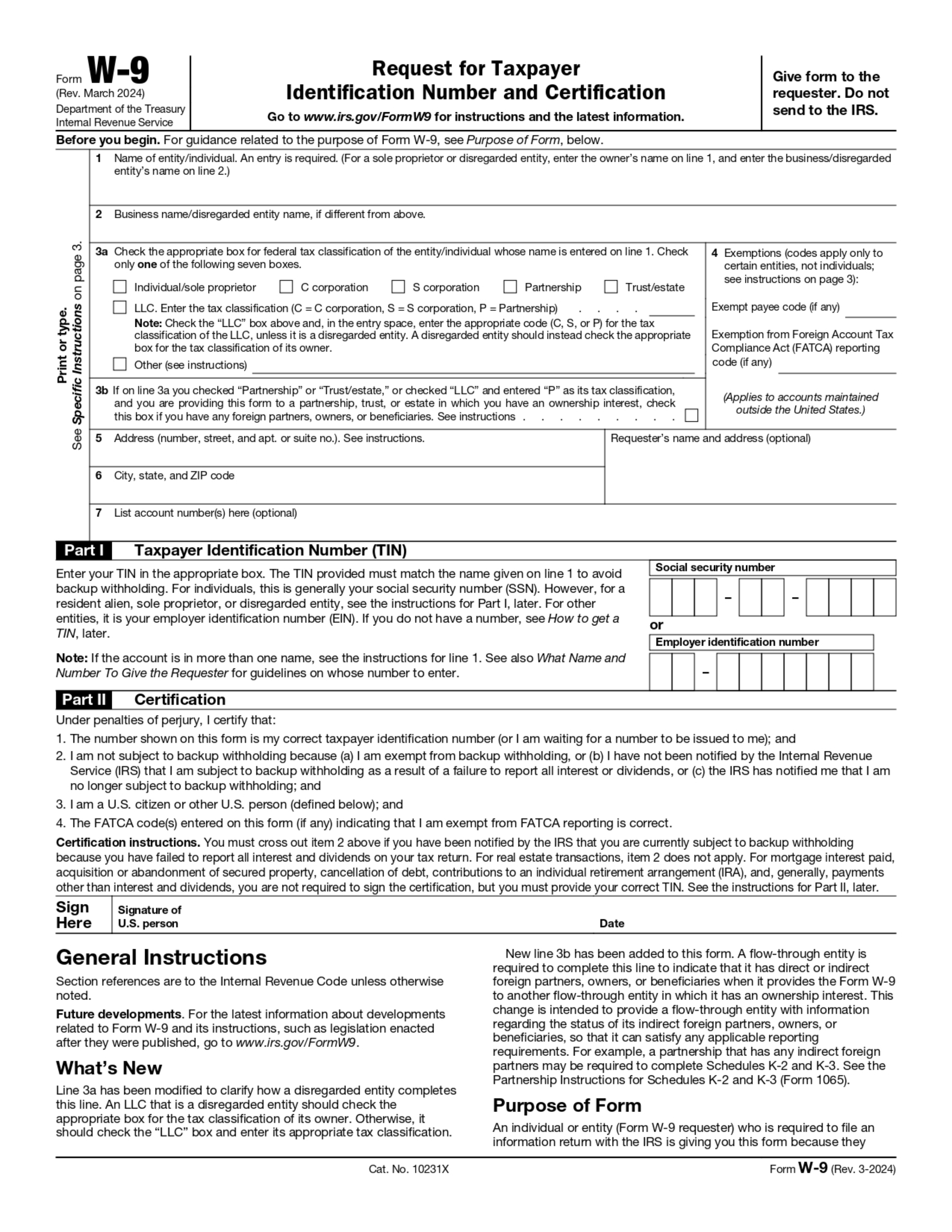

IRS W-9 2024 free printable template

Complete your W-9 Form in Seconds

PDFsail is not affiliated with lRS

Get, Create, Make and Sign

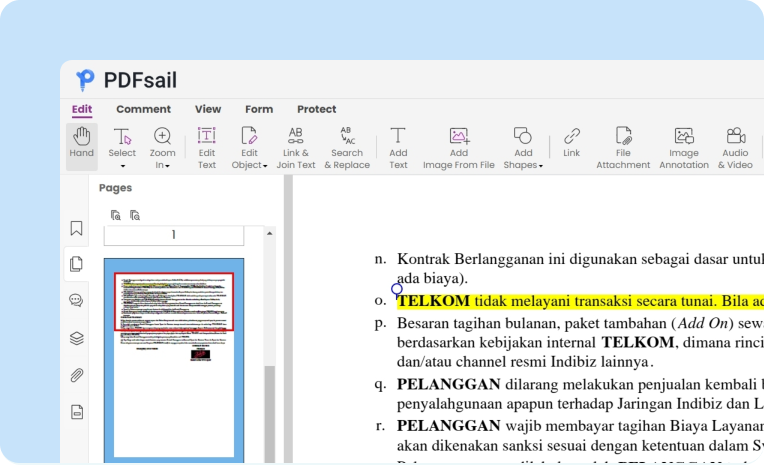

Fill out your form

Our user-friendly editor helps you quickly enter personal & business details in the W9 template.

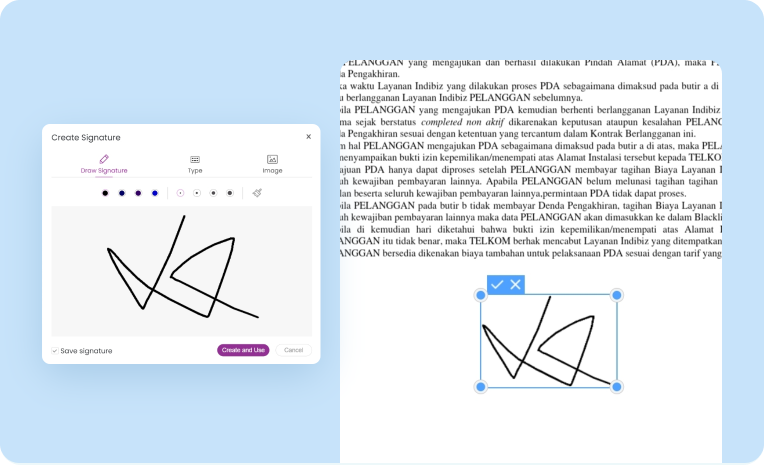

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Submit your tax return

Send your completed form to the IRS electronically or present it to them in person.

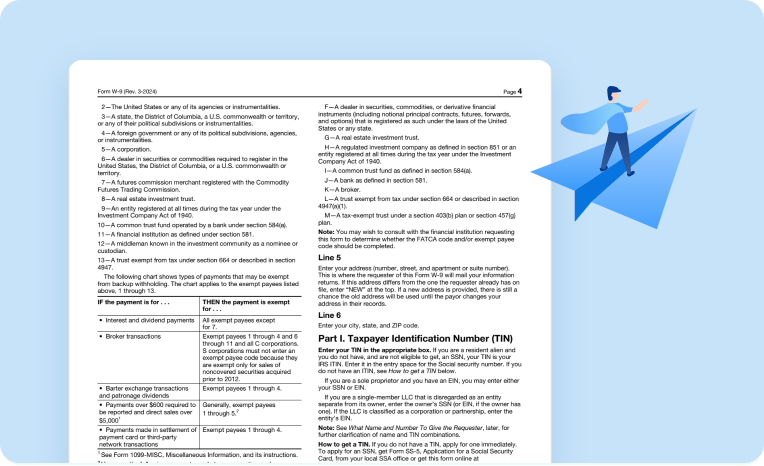

How to fill out a W-9 online?

Click the button under this section to complete the W-9 form online.

Enter your personal, business, and tax ID information in the fillable W-9 form. Certify the form with your digital signature and date.

Download and instantly print or share your signed W-9 with the requester.

What is a W-9 Form?

The Form W-9, titled "Request for Taxpayer Identification Number and Certification," is a document used in the United States for tax-related purposes. It is commonly employed in business transactions where one party needs to report payments made to another party to the Internal Revenue Service (IRS). The primary purpose of the W-9 form is to collect essential information from the taxpayer, such as their name, business name (if applicable), address, and taxpayer identification number (TIN) or Social Security Number (SSN). The recipient of the completed W-9 uses the information to ensure accurate reporting to the IRS and to determine whether backup withholding is necessary.

People Also Ask about W-9 Form

How is Form W-9 information used?

If a business or a person hires a contractor during the year, and this contractor is paid at least $600, the business who hired them has a legal obligation to report the services to the IRS. They’ll do so using the 1099 form. After you receive your Form W-9 with information about the contractor, you need to use this information to fill out the relevant portions of the 1099.

When should this form be filed?

If possible, it's helpful to file this form well in advance of tax season. That way, you already have all the required information when it’s time to fill out your 1099s. You don't want to miss a window of opportunity, wait excessive time for the form to process, and find yourself missing deadlines for tax filing.

Do foreign entities or companies need to use this form?

If they did business with a contractor who has a TIN, then yes, they do. They should also make sure they fill out any other required documentation for foreign tax filing.