IRS 1099-MISC 2024 free printable template

Complete your 1099 Form in Seconds

PDFsail is not affiliated with lRS

Get, Create, Make and Sign

Fill out the 1099 form

Access our 1099 Form 2024 and provide the required information, such as your name, contact details, etc.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Submit your tax return

Send your completed form to the IRS electronically or present it to them in person.

How to file Form 1099?

Click the button under this section to complete the 1099 form online.

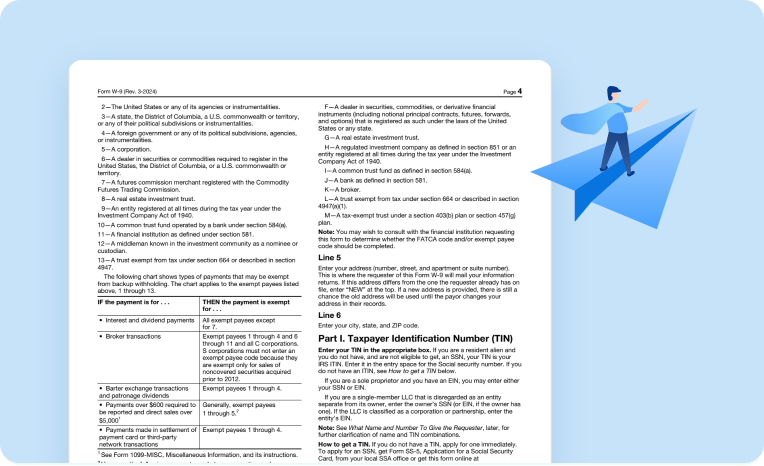

Fill out the complete form, providing all the required data, such as your name, address, TIN, etc

Download the completed, printable 1099 Form 2024

What is a 1099-MISC Form?

The IRS Form 1099-MISC is a report you send to the party that provides paid services (independent contractor). The document includes details about any money spent on your business course, not personal expenses. In 2021 the title of Form 1099-MISC had changed from Miscellaneous Income to Miscellaneous Information.

People Also Ask about 1099 form

I received a 1099. What do I do with it?

As a professional, receiving the form gives you a way to report your income correctly. Be thorough when checking the form filled out by your payer. Make sure all the information, like your name, contact details, TIN, etc, is correct. After verifying everything, you need to report your income and pay any relevant taxes.

When is Form 1099 due?

Form 1099 is due by January 31st. Complete it early using our quick form filler to avoid late penalties.

Where do you send 1099 Forms?

The IRS offers a Taxpayer Portal for digital tax form submissions, including Form 1099. If you prefer, you can also mail a printed copy to your nearest IRS processing center.

How much taxes do you pay on a 1099?

The combined tax rate is 15.3%, including 12.4% for Social Security and 2.9% for Medicare. This is typically paid by the employer, though it may sometimes be split between the employer and the employee.