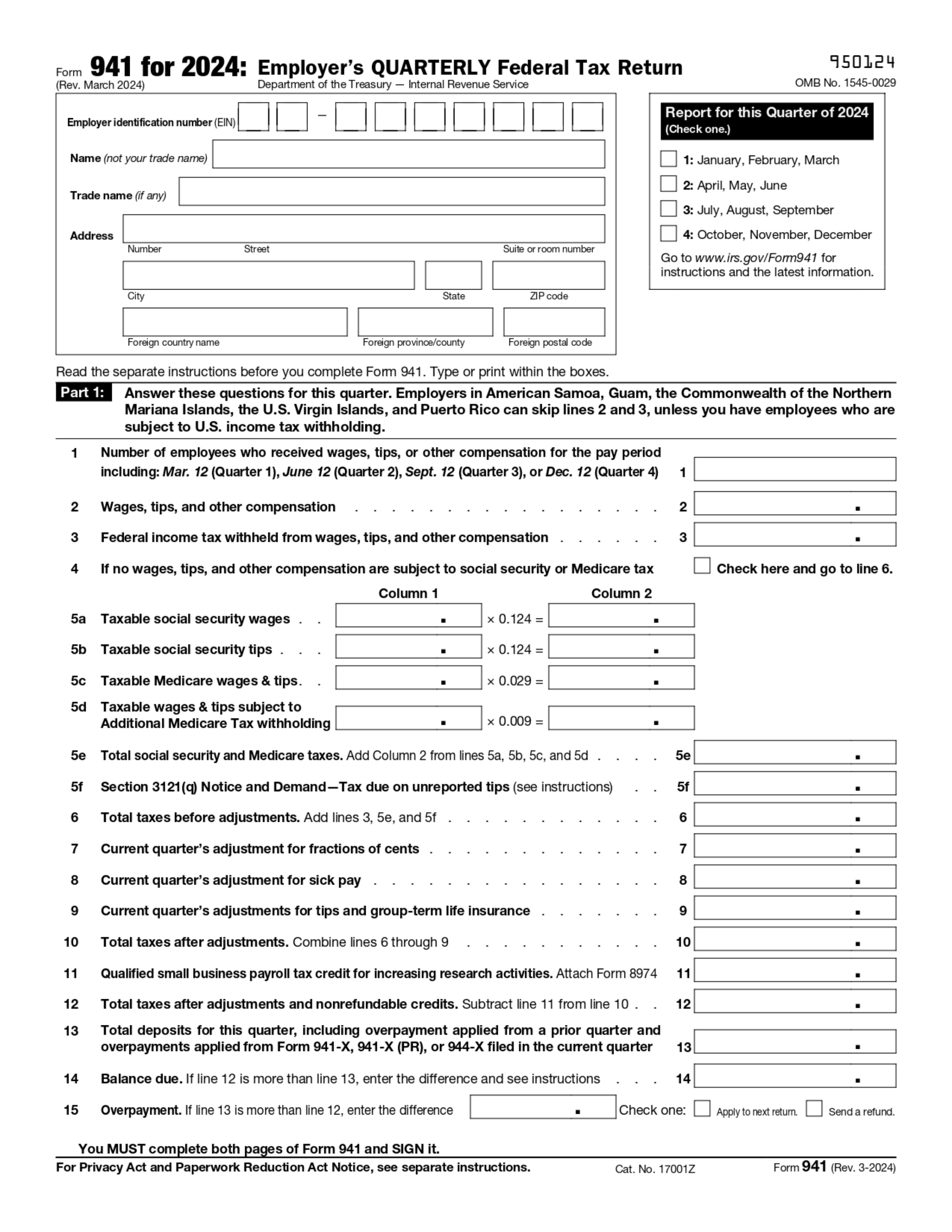

IRS 941 2024 free printable template

Complete your 941 Form in Seconds

PDFsail is not affiliated with lRS

Get, Create, Make and Sign

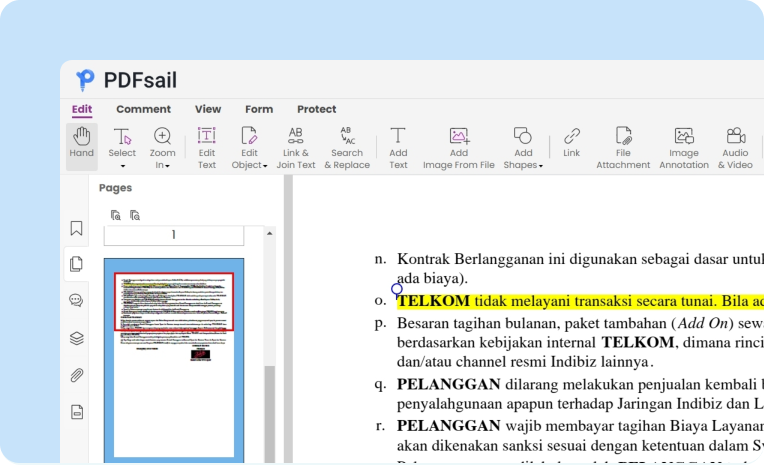

Input your details

Add all the required information to your 941 Form with the help of PDFsail.

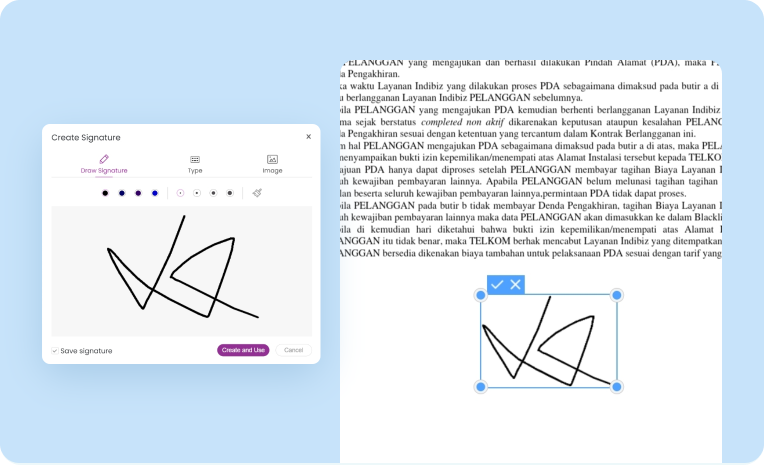

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Submit the form

Send your completed Form 941 for 2024 electronically or by mail, together with the other required documents

How to fill out a 941 Form online

Click the button under this section to complete the 941 form online.

Follow the IRS requirements carefully to fill out Form 941 for 2024

Verify the information on your 941 Form online and download the file

What is Form 941?

Form 941 is also known as the Employer's Quarterly Federal Tax Return. In short, it is a document used by employers in the United States. Through it, federal income taxes withheld from employees' wages are reported. But there is more. Social security contributions made during a fiscal quarter are also reported with this form. Such quarterly submission makes it easier: the IRS can actually monitor tax payments more efficiently.

People Also Ask about 941 form 2024

Who needs to file Form 941?

The employer is responsible for filling out the 941 Form for 2023. They must indicate whether they are subject to additional taxes, such as the employer's share of Social Security and Medicare taxes. To complete this process, you can use PDFsail to fill out the document online. Once completed, you have the option to print it or send it electronically.

What do you need to report on Form 941?

Form 941 for 2024 requires reporting various items, especially payroll-related taxes. This includes employee wages, federal income tax withholdings, and Social Security and Medicare payments, applicable to both employers and employees. Any adjustments or credits must be reported and properly accounted for on this form. Additionally, don't forget Schedule B Form 941, detailing quarterly tax liability, and use Form 941-X for any necessary corrections.

Can you file Form 941 electronically?

Yes, employers can file the 941 Form electronically. This is very convenient not only for the employer himself but also for the IRS, which encourages this method. It indeed allows for a more efficient and faster, but also more secure, audit. No more sheets of paper, but a digitization that makes life easier for more and more people. In addition, this system speeds up the processing of tax returns.