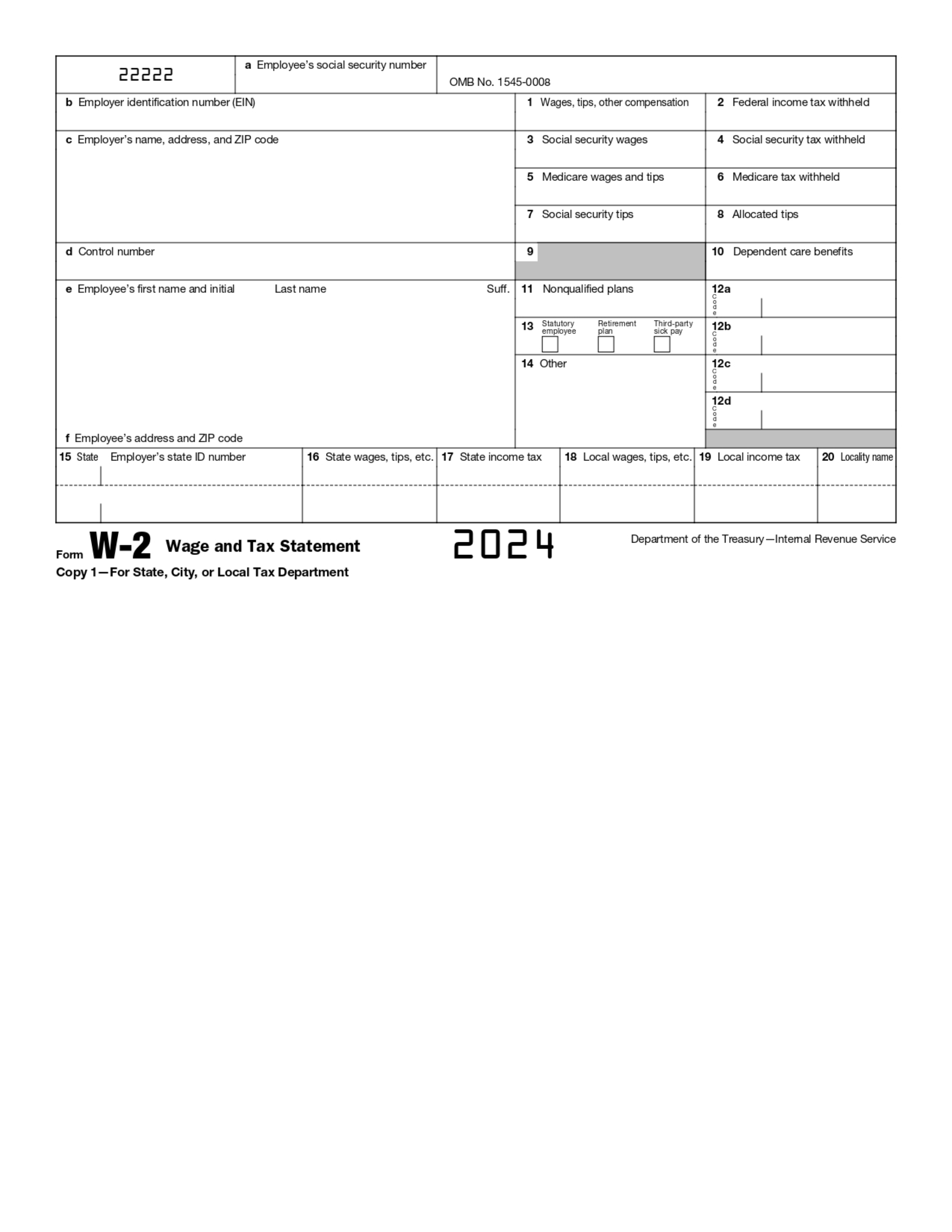

IRS W-2 2024 free printable template

Complete your W-2 Form in Seconds

PDFsail is not affiliated with lRS

Get, Create, Make and Sign

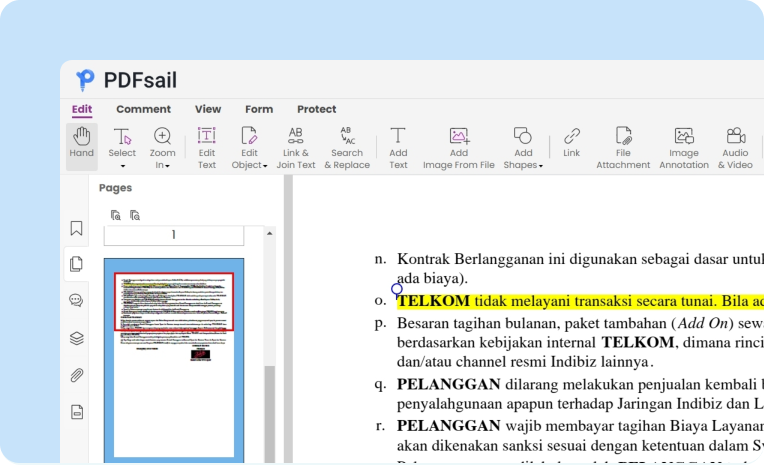

Fill out the W-2 tax form

Add the required information to the W-2 Form using our tool.

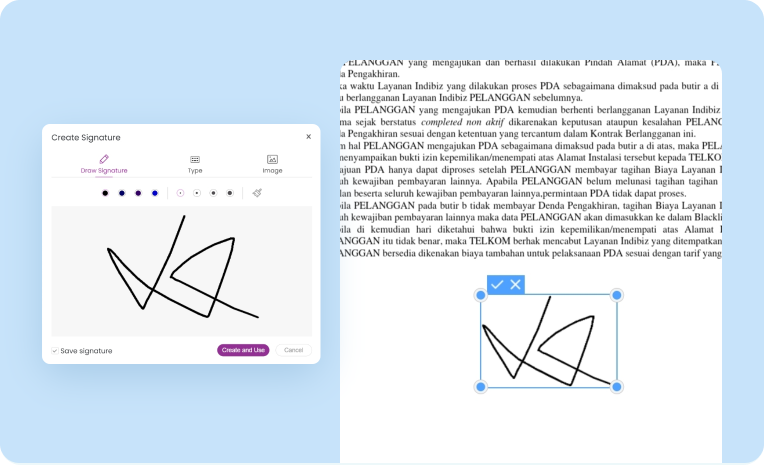

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Send it to your employer

Send the W-2 Form via email or regular post to your employer for verification.

How to fill out a W-2 Form?

Click the button under this section to complete the W-2 form online.

Enter all the required information following IRS requirements

Verify the information on your W-2 Form online and download the file

What is a W-2 Form?

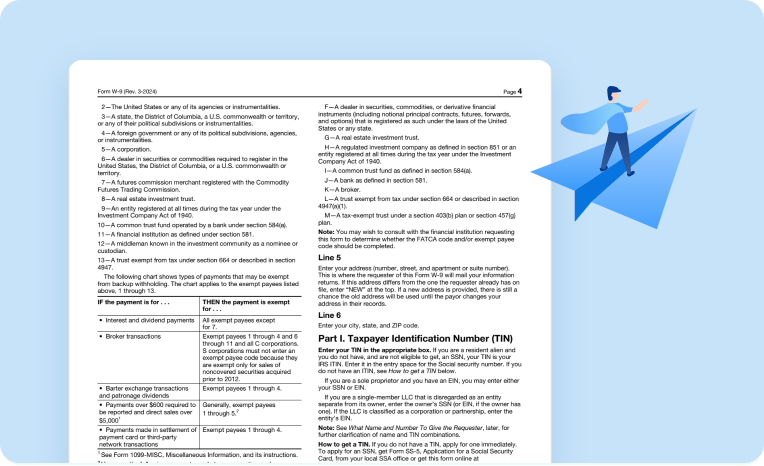

The W-2 form, also known as the Wage and Tax Statement, is commonly used by taxpayers. Employers complete this form for their employees. The 2024 W-2 form is concise yet essential for taxpayers, as its information is crucial for completing tax returns.

People Also Ask about form w-2 wage

When should you get your W-2 form from your employer?

The last day of January is the usual cutoff point to receive the W 2 tax form.

Why do you need a W-2 or 1099 Form for tax software?

In a word, “accuracy.” When you're using tax preparation software, having forms W-2 and 1099 ensures all the details of income and taxes are at your fingertips.

What is the difference between a 1099 and W-2

The 1099-MISC form is for payments to independent contractors, while the W-2 form is for payroll employees to report their taxable income.